Estate Planning & Donating Non-Cash Assets

The St. Christopher Truckers Fund serves over-the-road truck drivers across the nation. Truck drivers are responsible for transporting 70% of the country’s freight. The world relies on them to get medicine, food, raw materials, and other essentials. Without truckers, most of us wouldn’t be able to receive our needs or go about our daily lives. They sacrifice their health and families to bring keep American moving. You can thank these Highway Heroes by including the St. Christopher Fund in your estate planning and/or donating non-cash assets.

If you would like more information on estate planning, Fidelity has a great overview, tool kit, and information. You can find that here.

Charles Schwab also has amazing information about donating non-cash assets. Read below for their information.

When deciding what to contribute to your account, consider appreciated non-cash assets. You can always contribute cash, but appreciated non-cash assets held more than a year can help you achieve maximum philanthropic impact and help you reduce your taxes.

How can you have more to give to charity?

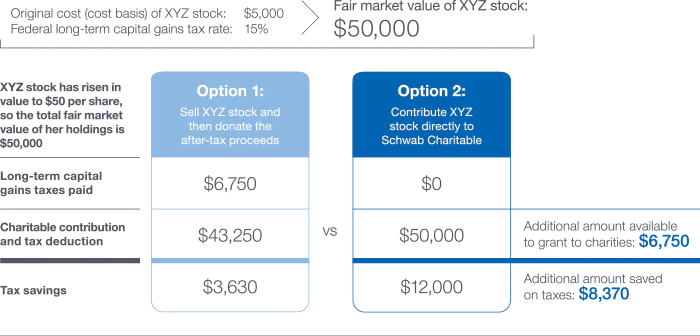

If you itemize deductions on your tax return instead of taking the standard deduction, donating non-cash assets can help you unlock additional funds for charity in two ways. First, you potentially eliminate the capital gains tax you would incur if you sold the assets yourself and donated the proceeds, which may increase the amount available for charity by up to 20%. Second, you may claim a fair market value charitable deduction for the tax year in which the gift is made and may choose to pass on that savings in the form of more giving.

Let’s say you own XYZ stock with a current fair market value of $50,000. The stock has gained $45,000 in value over the years since you purchased it for $5,000. A direct contribution of the stock to a donor-advised fund or other charity (option 2), in comparison to a sale and donation of after-tax proceeds (option 1), may free up an additional $6,750 to grant to charities and potentially provide additional tax savings of $8,370.

Disclosure

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor’s income tax rate (24% in this example), minus the long-term capital gains taxes paid.

Are you interested in a specific type of non-cash asset?

Learn more by reading our overview article or select any of the choices below to see asset-specific guidelines.

Publicly traded securities

Privately held business interests

Fine art and collectibles

Would you like more information?

Review Schwab’s infographic to better understand the benefits and process of donating non-cash assets.